[Wintermute] Lead Counterparty Risk Manager

招聘岗位

About Wintermute

At Wintermute our mission is to enable, empower and advance the truly decentralized world for more transparent and efficient markets and products. We do this by providing liquidity algorithmically across most trading venues in crypto, supporting all major centralized and decentralized trading venues, AMMs, RFQs, aggregators and chains. Wintermute’s customer-facing business includes various OTC products such as electronic trading API and single-dealer platform for a wide range of counterparties from crypto native whales to large traditional finance institutions. Wintermute is also providing market making services for blockchain projects where we support most of the world’s largest and most prominent launches. In addition to providing the best in class liquidity products, Wintermute is actively participating in the building and development of the blockchain ecosystem through investments from Wintermute Ventures, partnerships and co-development with upcoming protocols and incubation of own projects. Wintermute is a hyper-growth highly profitable business with a very ambitious vision and roadmap. We manage billions of dollars in assets and trade more than $5B/day. We are backed by Lightspeed, Pantera Capital, Sino Global Capital, Blockchain.com Ventures, Avon Ventures by Fidelity Investments, DeFi Alliance and other top tier investors. We are run as a technology company, not a financial service provider, and we build our culture around core values of ambition, collaboration, entrepreneurship, transparency and meritocracy.

Risk Management at Wintermute

Lead Counterparty Risk Manager is a vital role to Wintermute’s growing OTC and counterparty-facing business. You will build risk management framework for a large number of products (spot, derivatives, electronic and voice trading, borrowing, etc) and types of counterparties. You will work closely with senior Business Development managers, traders, middle office & trading operations as well as senior management to introduce risk frameworks and execute on them.

Responsibilities

- Design a counterparty risk framework for a large variety of OTC and other business activities, such as assessing counterparty and margining risks and setting appropriate limits

- Develop and implement collateralization monitoring and liquidation processes

- Take ownership and control of all risks associated with counterparties

- Communicate with relevant counterparties through risk and credit assessments

- Modify parameters that affect all products that Wintermute trades

- Draft risk frameworks and risk appetite statements and define key risk indicators

- Document proposed risk tolerance thresholds of counterparties along with supporting rationale for presentation to senior management

- Develop and implement policies and processes to control risks, limit liabilities, and strengthen governance processes.

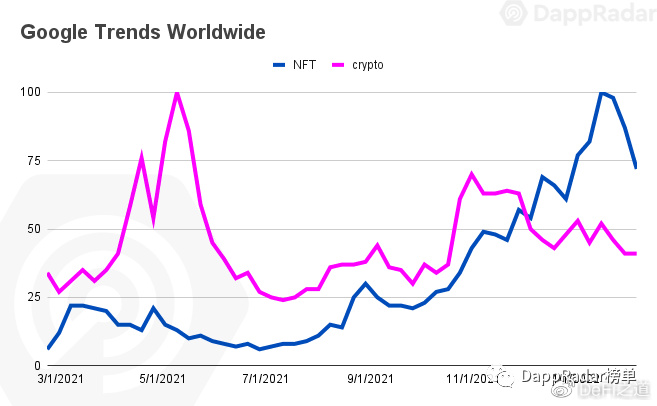

- Analyse market trends, reports, statistics, and relevant documentation, then inform relevant stakeholders as appropriate.

Requirements

- At least 3 years’ experience in Risk Management role with relevant responsibilities in a top tier/high performance financial institution.

- Experience building risk management frameworks in spot and derivatives market in traditional finance

- Understanding of OTC trading workflows

- Experience with the crypto markets is an advantage but not required; you should be able to quickly understand how crypto markets may be different

- Strong commercial acumen that includes ability to take calculated risks, proactively identify and mitigate risks, develop tailored solutions (vs one size fits all “by the book” approach)

- Entrepreneurial and hands-on attitude, understanding the trade off between growth and risk

- Strong quantitative skills and high confidence working with numbers, large datasets

- Basic coding skills, SQL and Python would be an advantage

- Bachelor’s degree in a quantitative or relevant business subject

Wintermute Offer

- A unique opportunity to work on very interesting projects, get the level of responsibility and ownership that would take 5-10 years to get in a traditional trading company/bank/hedge fund

- A unique opportunity to join a high growth startup and one of the strongest and highest potential crypto startups based in Europe

- Great culture: highly professional and ambitious, yet informal, non-hierarchical, collaborative and entrepreneurial

- A cool office in Singapore

7*24小时快讯

热门资讯

最新活动