[OKX] Junior Quantitative Researcher

招聘岗位

About the job

About OKX:

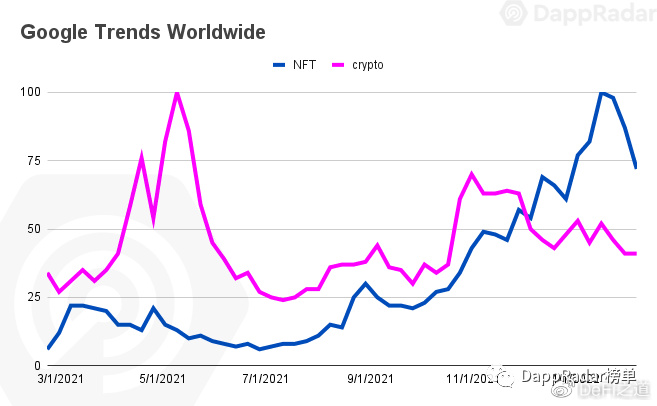

At OKX, we believe our future is reshaped with technology. Founded in 2017, OKX is one of the world’s leading cryptocurrency spot and derivatives exchanges. OKX innovatively adopted blockchain technology to reshape the financial ecosystem by offering some of the most diverse and sophisticated products, solutions, and trading tools on the market. Trusted by more than 20 million users in over 180 regions globally, OKX strives to provide an engaging platform that empowers every individual to explore the world of crypto. In addition to its world-class DeFi exchange, OKX serves its users with OKX Insights, a research arm that is at the cutting edge of the latest trends in the cryptocurrency industry. With its extensive range of crypto products and services, and unwavering commitment to innovation, OKX vision is a world of financial access backed by blockchain and the power of decentralized finance.

We invest in our people as much as we invest in technology. We are united by our engaging culture, here we win as a team, embrace changes, and do the right thing. We are committed to creating a friendly, rewarding and diverse environment for OKers. It doesn’t matter where you come from, here everyone feels valued, respected and has the same opportunities to develop and thrive — we want to bring out the best in you.

About the Team:

All team members in the options team are from leading hedge funds and major investment banks such as Goldman, JP Morgan, and so on with a strong understanding of trading and technology. Our goal is to improve the existing systematic strategies.

About the Role:

The candidate will work together with senior strategist on many aspects of the options business, including risk management, options pricing and strategies development.

Responsibilities:

- Monitor the options risk management system and verify the corresponding Greek numbers

- Monitor market dynamics to keep a track on changes in the financial market

- Analyze data and conduct quantitative research on market data

- Backtesting and scenario analysis on the market and strategies

- Maintain the internal database and do the data cleaning

Requirements:

- Solid STEM (Science/Technology/Engineering/Mathematics) education background

- Fluent with at least one script language, preferably in Python

- Knowledge of probability theory, statistics methods and machine learning algorithms

- Strong logical thinking and problem-solving skills

- Fluent in English

Preferred Qualifications:

- Options trading experience or knowledge of options strategies

- Experience in data analysis and backtesting

- Experience working on time series database

- Ability to work under pressure in a fast-paced environment

- Willing to learn all aspects of trading products in financial and crypto markets, including spot, future, swap, options, structured products and Defi trading

7*24小时快讯

热门资讯

最新活动